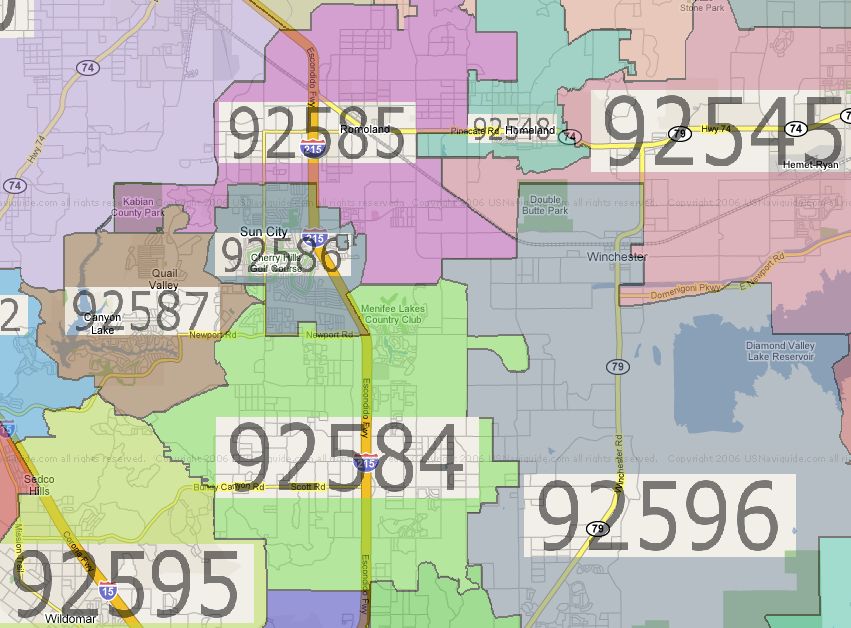

Property Taxes by Zip Code?

Well not exactly. Property tax is determined by your state and county. Currently there aren’t any simple plug and play online tools to find outwhatyour property taxes are. But you have a few options.

In California, your property taxes are determined by a combination of factors:

- The Proposition 13 rate of 1%, which was initiated in 1978 and is the same for all California Counties.

- Taxes that go toward paying your local voter-approved debt. This will differ depending on local laws.

- Parcel taxes, used primarily to fund local education.

- Mello-Roos taxes, used to pay local bonds for services, local government, and infrastructure.

- Property value assessments, the value the county thinks your real estate is worth.

Find out your property taxes by zip code. Sort of. Try one of these options

1. Contact your California County Assessor.

Head over to your local County Assessor’s Office, or alternately the Recorder’s Office. You’ll need your property’s address and zip code or Parcel ID. You can inquire in person with the County Assessor or Recorder, go to their website, or even use standard mail. The assessor will be able to tell you the tax rate for your property.

2. Talk to a local real estate agent.

Local real estate agents may also be able to help you figure your property taxes. Agents have access to MLS, or Multiple listing services that contain the property taxes for specific real estate. The real estate agents can look at the records and find information about the past and present of a property.

3. Use online real estate tools to determine property tax.

Zillowis a website that’s a great resource for real estate research. Inputting your property’s full address and zip code offers up detailed information on the area and specific home. A “tax paid” section includes recent tax history for the property. You can find this in “Charts and Data” section of Zillow.

Property Sharkis another useful website for figuring out your home’s property taxes. You can search properties by address and zip code to find home values, tax data, and other relevant information.

4. Contact a property tax professional.

Again, there is no comprehensive platform for finding current property taxes by zip code. And remember, property taxes vary from county to county and from property to property. The best advice you could listen to is that of a property tax professional. Go with the Pros, people who have appeal property tax cases thousands of times before. Experts in the property tax field will know the ins and outs of property tax law and property valuation. Make sure your property tax professional is also a state certified appraiser. Property appraisers have specialized training and work more efficiently to exactly value your case for a possible property tax reduction.